Everyone running ads, building a website, or growing a brand eventually asks the same question: “Is this actually working?”. If you don’t have the numbers, you’re flying blind, throwing money into the void, and just hoping something sticks.

Marketing metrics are your eyes in the digital world. They tell you what’s working, what’s trash, and what you need to stop right now before it burns your budget.

Imagine two businesses:

- Company A: Invests $50,000 in ads and tracks the right metrics — CAC (Customer Acquisition Cost), LTV (Lifetime Value), and Retention Rate. They know exactly which campaigns bring in the most profitable customers, optimize their spending, and scale profitably.

- Company B: Also spends $50,000 but focuses on vanity metrics — likes, clicks, and engagement. They assume a high CTR (Click-Through Rate) means success, but they never check if those clicks lead to sales. Three months later, they’re out of money, confused, and blaming the algorithm.

The difference? One business tracks the right numbers and scales, while the other blindly spends and fails. You either control your marketing or your marketing controls you.

Bottom line: If you’re not tracking your numbers, you’re not running a business — you’re just gambling. In the next sections, I’ll break down the key metrics you actually need to know and how they can completely change your game.

I. The Numbers That Actually Matter

If you’re not tracking the right numbers, you’re guessing, not growing. Marketing isn’t about throwing money at ads and hoping for the best — it’s about measuring what works and doubling down on it.

There are dozens of metrics out there, but only a few actually determine whether your business is making money or just making noise. Here’s the list of the core marketing metrics you need to track:

- ROI (Return on Investment)

- CAC (Customer Acquisition Cost)

- LTV (Lifetime Value)

- Conversion Rate

- CTR (Click-Through Rate)

- Churn Rate

- Retention Rate

- Organic vs Paid Traffic

- Social Engagement

- Email Open Rate & CTR

- Net Promoter Score (NPS)

Each of these metrics exists for a reason—they reveal whether your marketing strategy is effective or a complete waste of time. Now, let’s break them down one by one and see how they actually impact your business.

II. ROI (Return on Investment)

Let’s be real — ROI is the only metric that truly matters. Everything else is just noise if you’re not making more money than you’re spending. No matter how many clicks, likes, or comments you get, if your return on investment is negative, you’re not running a business — you’re burning cash.

But here’s the problem: most people don’t track ROI properly. They see revenue coming in and think they’re profitable. Meanwhile, their marketing expenses are bleeding them dry. So, let’s break ROI down into the simplest and most effective way to track it.

What Is ROI? (And Why It’s the Lifeblood of Your Business)

ROI (Return on Investment) is a simple but powerful formula that tells you how much profit you’re making compared to how much you’re spending.

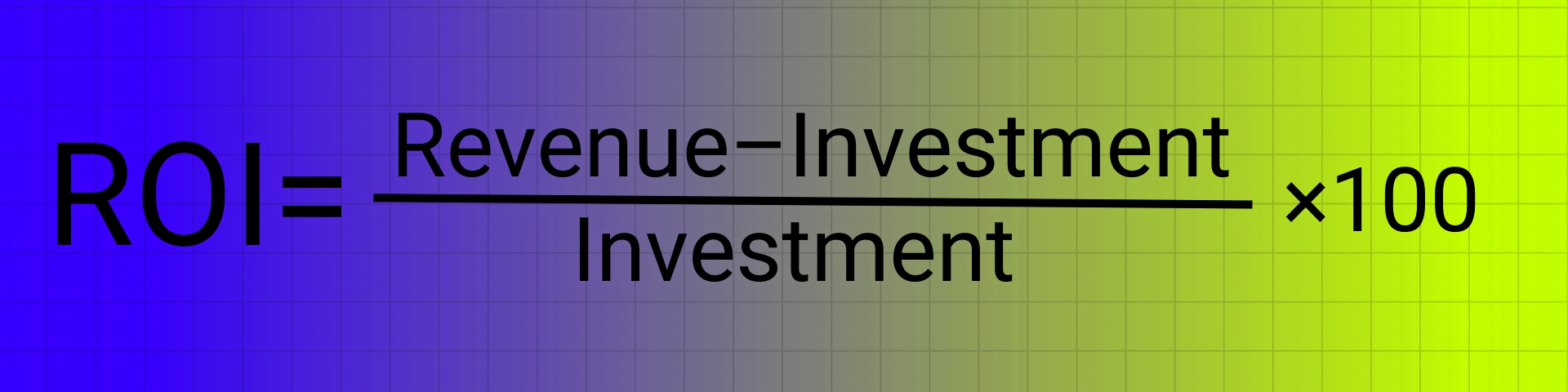

The formula:

This gives you a percentage that tells you how efficient your marketing efforts are.

Example:

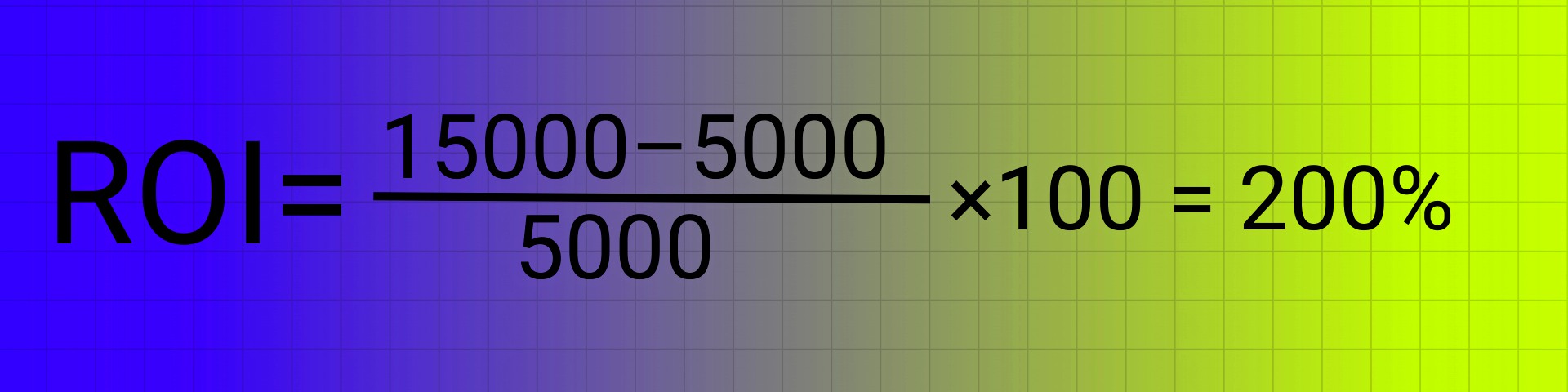

- You spent $5,000 on Facebook ads.

- Those ads generated $15,000 in revenue.

- Your ROI:

A 200% ROI means you made 2x your investment back. That’s solid. But if your ROI was negative (below 0%), you’re losing money and need to fix your strategy ASAP.

Why ROI Matters (And Why Most Businesses Ignore It Until It’s Too Late)

Many businesses fail because they focus on vanity metrics instead of real profit. They get excited about high engagement, thousands of followers, or website traffic but forget that none of that matters unless it turns into actual revenue.

ROI forces you to be brutally honest about what’s working and what’s not. It helps you:

1️⃣ Identify waste – If something isn’t making money, cut it.

2️⃣ Scale the winners – If an ad campaign has a high ROI, put more budget into it.

3️⃣ Make smarter decisions – No more guessing, only data-driven moves.

If you’re not tracking ROI, you’re gambling, not running a business.

How to Measure ROI in Different Marketing Channels (The Right Way, Not the Lazy Way)

Most marketers think they’re tracking ROI, but in reality, they’re just looking at surface-level numbers. Platforms like Facebook Ads and Google Ads inflate their reported ROAS, SEO agencies claim “growth” based on traffic alone, and influencers promise “exposure” without proving real conversions.

If you don’t track ROI properly, you’re making blind decisions and probably wasting a ton of money. Here’s how to measure actual ROI across different channels, even when tracking is broken or incomplete.

📌 Paid Ads (Google, Facebook, TikTok, etc.)

Paid advertising is often considered the easiest channel to track because ad platforms provide detailed metrics — but this is also where businesses make some of the biggest ROI tracking mistakes. Many marketers rely entirely on ROAS from the ad platform’s dashboard, assuming it tells the full story of performance. However, this approach is fundamentally flawed because ad platforms do not account for delayed conversions, they often over-attribute sales to themselves, and most attribution models fail to reflect real customer buying behavior. As a result, businesses frequently shut down ad campaigns that are actually profitable in the long run, simply because they only look at short-term ROAS.

How to Measure Paid Ad ROI Correctly:

✅ Use UTM parameters + GA4 Assisted Conversions

- How? Add UTM tags to all paid ads

- Where? Track in GA4 → Advertising → Assisted Conversions

- Why? Prevents Google & Facebook from taking credit for sales that came from another channel

✅ Set up server-side tracking (GTM + Facebook Conversion API)

- How? Use Google Tag Manager Server Container + Facebook Conversion API

- Where? Setup Guide

- Why? Recovers 30-50% of lost tracking data due to iOS14+ privacy changes

✅ Compare blended CAC vs. platform CAC

- How? Track total CAC across all channels instead of just looking at Facebook/Google separately

- Where? Use GA4 + Google Sheets to calculate CAC

- Why? If your blended CAC is lower, it means your marketing channels work together

✅ Track new vs. returning customer revenue separately

- How? In GA4 → Reports → Retention → New vs. Returning Users

- Why? Ads that bring repeat buyers have long-term ROI, even if ROAS looks bad initially

Common mistakes in ad ROI tracking:

❌ Relying only on ROAS – Ad platforms over-attribute sales to themselves

❌ Ignoring delayed conversions – Users often buy days or weeks later

❌ Not comparing blended CAC vs. platform CAC – Looking at Facebook CAC in isolation is misleading

📌 SEO & Content Marketing

SEO is one of the most misunderstood marketing channels because while it can drive massive organic traffic, it’s difficult to track true ROI. Many businesses make the critical mistake of measuring SEO success based on traffic growth, keyword rankings, or pageviews instead of actual revenue generation. The problem is that organic search traffic rarely converts immediately — users might browse today and return to purchase weeks later, often through another channel. Without proper tracking, businesses waste thousands on content creation and link-building without ever knowing if it’s generating sales.

How to Measure SEO ROI Correctly:

✅ Use hidden UTM fields in lead forms

- How? Auto-fill utm_source=organic in forms

- Where? Use Google Forms, HubSpot, or Shopify

- Why? Ensures SEO conversions are tracked correctly, even if they happen weeks later

✅ Check assisted conversions in GA4

- How? In GA4 → Advertising → Assisted Conversions

- Why? Reveals how SEO traffic helps conversions, even if the sale happens via another channel

Common mistake:

❌ Thinking SEO is “free” – Content, backlinks, and tools cost money, but without tracking conversions, it’s just an expense.

❌ Measuring traffic instead of revenue – High rankings mean nothing if visitors don’t convert into leads or customers.

❌ Ignoring assisted conversions – SEO visitors often buy later via email or retargeting, but last-click attribution hides this impact.

📌 Email Marketing

Email marketing is one of the highest-ROI channels, but only if tracked correctly. The biggest mistake companies make is focusing on vanity metrics like open rates and click-through rates instead of actual revenue generated. A high open rate is meaningless if emails don’t lead to sales. Successful email marketing isn’t about sending more emails — it’s about sending the right emails to the right people at the right time while measuring actual business impact.

How to Measure Email ROI Correctly:

✅ Use UTM tracking in every email

- How? Add

utm_source=email&utm_campaign=spring_promoto all email links - Where? Track in GA4 → Acquisition → Campaigns

- Why? Lets you see exactly how much revenue comes from email

✅ Track revenue per email campaign

- How? In Klaviyo, Mailchimp, or HubSpot, check revenue per email

- Why? If 20% of emails bring 80% of revenue, focus on what works

✅ Measure repeat purchase rates from email leads

- How? In GA4 → Reports → Retention → Customer Lifetime Value (LTV)

- Why? Email leads often have a higher LTV than paid traffic

Biggest email marketing mistakes:

❌ Tracking open rates instead of revenue

❌ Sending the same email to everyone instead of segmenting

📌 Social Media (Likes Don’t Mean ROI)

Social media is a powerful tool for brand awareness and engagement, but businesses that fail to track ROI correctly end up wasting money. The biggest trap? Measuring success based on likes, comments, and follower count instead of actual revenue impact. Social media is often an indirect conversion channel — users might engage with content but convert later through paid ads, email, or SEO. Without a proper tracking system, businesses keep investing in vanity metrics while their revenue suffers.

How to Measure Social Media ROI Correctly:

✅ Use GA4 to separate brand awareness vs. direct-response traffic

- How? Track social referral traffic and compare first-click vs. last-click conversions

- Where? In GA4 → Reports → Traffic Sources

✅ Run retargeting ads to organic social visitors

- How? Use Facebook Custom Audiences to retarget users who engaged with social content

- Why? Most social visitors don’t convert immediately, so bring them back later

✅ Use deep-linking in stories and posts

- How? Use Branch.io or Bitly to track clicks-to-sales

- Why? Instagram & TikTok suppress external links, deep-links increase conversion rates

Common mistakes:

❌ Measuring likes & comments instead of revenue

❌ Ignoring how social media assists other channels

General ROI Mistakes That Will Kill Your Business

Even businesses that track ROI often make huge mistakes that distort their real profitability. Here are the biggest ROI killers:

❌ Not considering all costs – Many businesses only look at ad spend but forget hidden costs like software, team salaries, and production. Your real ROI is revenue minus ALL costs.

❌ Chasing cheap clicks instead of real conversions – Low-cost ads can bring in a ton of traffic, but if that traffic doesn’t convert into sales, you’re just wasting money.

❌ Ignoring customer lifetime value (LTV) – Sometimes, acquiring a customer at a loss is worth it if they keep buying from you. LTV needs to be factored into your ROI calculations.

❌ Not testing & optimizing campaigns – You can’t just launch an ad and hope it works. A/B test your creatives, copy, and targeting to maximize ROI.

How to Improve Your ROI (And Make More Money Without Spending More)

A high ROI means you’re squeezing the most profit out of your marketing. Here’s how to boost your ROI fast:

🔥 Improve your targeting – Stop wasting money on people who will never buy. Use retargeting ads, lookalike audiences, and refined interest targeting.

🔥 Optimize your conversion funnel – If people are clicking but not buying, your sales page is the problem. Improve your website, landing pages, and checkout process.

🔥 Increase customer retention – It’s cheaper to keep a customer than acquire a new one. Focus on email marketing, loyalty programs, and upselling.

🔥 Track & cut low-performing campaigns – If an ad isn’t bringing in profit, turn it off and redirect the budget to what’s working.

🔥 Increase your prices – Many businesses have a low ROI because they charge too little. If your product delivers value, don’t be afraid to price it accordingly.

Final Thoughts: If You Don’t Track ROI, You’re Running a Charity, Not a Business

At the end of the day, marketing is about making money. ROI is the number that tells you if your efforts are profitable or just burning cash.

If you track nothing else, track ROI. Because if your return on investment is negative, nothing else matters — you won’t survive.

III. CAC (Customer Acquisition Cost)

If you don’t know how much it costs to acquire a customer, you’re flying blind in your business. CAC (Customer Acquisition Cost) tells you how much money you need to bring in a single paying customer.

Many businesses assume that lower CAC = better marketing. Wrong. A low CAC means nothing if your customers don’t spend enough to cover the cost. You need to compare CAC with LTV (Lifetime Value) to ensure long-term profitability.

How to Calculate CAC (Beyond the Basic Formula)

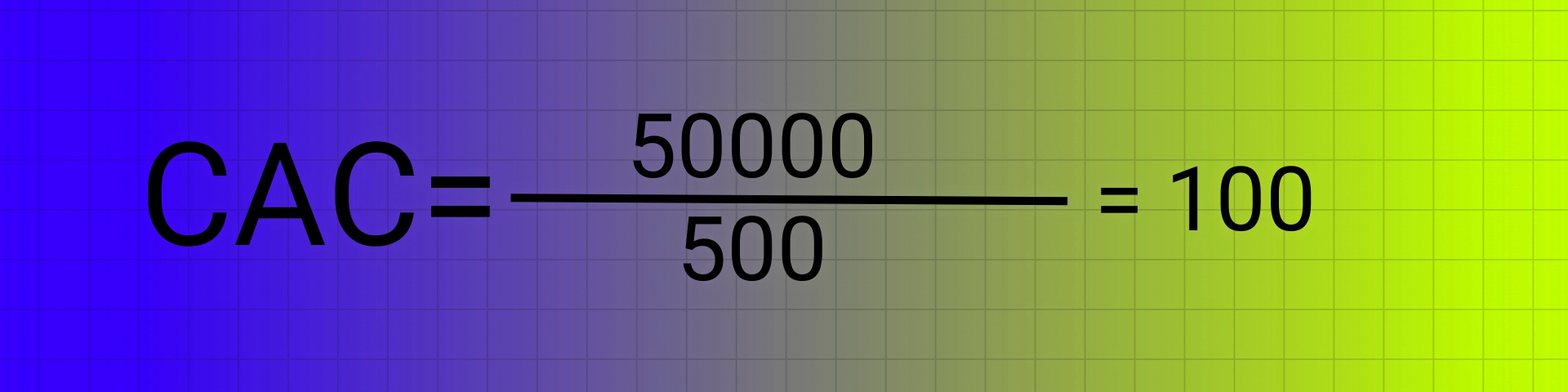

Most people throw around the standard CAC formula:

But this formula doesn’t tell the whole story. If you’re only counting ad spend, you’re missing a ton of hidden costs like:

- Salaries of marketing & sales teams

- Software costs (CRM, email tools, tracking tools)

- Agency fees & outsourced creatives

- Lead generation costs (SEO, content, outbound campaigns)

Real CAC includes everything it takes to acquire a customer — not just the money spent on ads.

Example Calculation:

A company spent $50,000 on customer acquisition in a month. Here’s the full breakdown:

- Paid Ads (Facebook, Google, TikTok): $25,000

- SEO & Content Marketing Costs: $10,000

- Sales Team Salaries (Proportional to Customer Acquisition Efforts): $8,000

- CRM & Email Automation Software (HubSpot, Klaviyo, etc.): $3,000

- Creative Costs (Designers, Copywriters, Video Production): $4,000

Total Customer Acquisition Costs: $50,000

During this period, the company acquired 500 new customers.

Final CAC Calculation:

This means the business spends $100 to acquire each new customer.

How to Track CAC in Different Channels

Not all customers cost the same to acquire. If you’re running multiple marketing campaigns, you can’t just look at your overall CAC and call it a day. You need to break it down by channel to see which ones bring in the best customers at the best cost.

Some channels, like paid ads, have an instant CAC — you spend money and get customers quickly. Others, like SEO, require upfront investment and only pay off months later. If you don’t separate CAC per channel, you might be wasting budget on low-efficiency traffic.

📌 Paid Ads CAC (Google, Facebook, TikTok, etc.)

Paid advertising gives fast, trackable results, but it can also be deceptively expensive if you don’t monitor the right numbers. Many businesses only track CPC (Cost Per Click) without considering the full cost of acquiring a customer.

✅ Track cost per conversion, not just CPC: Measure actual CAC inside Facebook Ads, Google Ads, and TikTok Ads, not just click costs. A low CPC doesn’t mean you’re acquiring customers efficiently.

✅ Eliminate wasted ad spend: Identify and exclude bot traffic, accidental clicks, and low-intent audiences that inflate costs. Use heatmaps and session recordings (Hotjar, Microsoft Clarity) to analyze visitor behavior.

✅ Compare blended CAC vs. platform-specific CAC: Facebook Ads might have a CAC of $50, while TikTok Ads might be $80—but what’s your blended CAC across all platforms? If blended CAC is significantly lower, your marketing mix is working efficiently.

🚨 Mistake: Scaling ad spend too fast without analyzing how CAC increases. Many businesses see initial success, double their ad budget, and watch their CAC skyrocket because they run out of high-intent audiences.

📌 SEO & Organic CAC

SEO is often perceived as free, but in reality, it requires investment in content, backlinks, and technical SEO. Unlike paid ads, SEO takes time to generate results, meaning CAC must be calculated differently.

✅ Factor in content production costs: Blog posts, videos, landing pages, and infographics all cost money to produce. A strong SEO strategy requieres high-quality content that converts visitors into customers.

✅ Include link-building expenses: Backlink outreach, guest posts, and PR placements improve rankings, but they come at a cost. If you spend $5K/month on backlinks, that needs to be factored into CAC.

✅ Track SEO conversions, not just traffic: Use Google Analytics Goals to measure how many organic visitors become paying customers. High rankings mean nothing if visitors don’t convert.

🚨 Mistake: Focusing only on keyword rankings instead of conversion-driven traffic. Some keywords bring thousands of visitors but very few buyers. Target keywords that actually drive sales.

📌 Email & Retargeting CAC

Email marketing and retargeting campaigns target warm audiences who are already familiar with your brand, making them cheaper than cold traffic. But they still cost money and should be accounted for in CAC calculations.

✅ Include CRM & automation tool costs: Email platforms like Klaviyo, HubSpot, and Mailchimp aren’t free. If you’re paying $2,000/month for email automation, that needs to be accounted for in CAC.

✅ Measure how many email leads actually convert: Open rates mean nothing if those leads don’t turn into customers. Track email-attributed revenue in GA4 and your email marketing dashboard.

✅ Use retargeting to reduce CAC: Customers who abandoned carts or visited product pages are much cheaper to convert than new cold leads. Retargeting on Facebook, Instagram, and Google Display Network can significantly reduce CAC.

🚨 Mistake: Over-relying on discounts to drive conversions. If you constantly send discount-heavy emails, your CAC might be low, but your profit margins take a hit. Focus on value-driven email marketing instead.

📌 Social Media & Influencer CAC

Social media CAC varies based on organic vs. paid traffic. Many businesses waste money on influencers because they track engagement instead of conversions.

✅ Separate organic vs. paid CAC: Organic posts may bring free traffic, but paid promotions must show a return. Track social media conversions inside GA4 → Acquisition → Source/Medium to see which efforts lead to actual customers.

✅ Calculate influencer ROI properly: If you pay an influencer $5,000 but they only generate 10 sales, your CAC is $500 per customer—not ideal. Always divide influencer fees by actual sales, not engagement metrics.

✅ Use discount codes & UTM tracking to measure influencer conversions: Unique promo codes and UTM-tagged links let you track influencer-generated sales separately from other social traffic.

🚨 Mistake: Focusing on large influencers instead of high-converting micro-influencers. Many brands assume that bigger audience = better ROI, but micro-influencers (10K-50K followers) often deliver higher conversion rates at a lower CAC.

Common CAC Mistakes That Are Killing Your Profitability

Most businesses miscalculate CAC and either overspend or underprice their products. Here’s where people go wrong:

❌ Not considering retention & repeat customers – If your customers buy multiple times, your CAC is effectively lower. Track LTV alongside CAC.

❌ Chasing low CAC without checking profitability – A cheap customer isn’t always a good customer. A high-value customer with a higher CAC can be more profitable if their LTV is high

❌ Ignoring CAC for different customer segments – Not all customers cost the same to acquire. A B2B lead might cost $500 to acquire but bring in $10,000 in revenue. A B2C customer might cost $10 but only spend $50 once. Segment your CAC by customer type.

How to Lower CAC Without Killing Your Business

The goal isn’t just to reduce CAC — it’s to make sure your CAC is sustainable and scalable.

🔥 Improve conversion rates – If you get more conversions from the same traffic, your CAC automatically drops. Optimize landing pages, checkout flow, and offers.

🔥 Focus on retention – A returning customer = $0 acquisition cost. Increase retention with email marketing, loyalty programs, and upsells.

🔥 Refine targeting – If your CAC is too high, you might be targeting the wrong people. Use lookalike audiences, better ad creatives, and audience exclusions.

🔥 Leverage organic & referrals – A customer who comes from SEO or word-of-mouth costs almost nothing compared to a paid ad lead. Encourage referrals with incentives.

Final Thought: If Your CAC Is Too High, Your Pricing Is Probably Too Low

A profitable business doesn’t just lower CAC—it prices products to make CAC irrelevant. If you can’t afford your customer acquisition costs, you’re charging too little.

IV. LTV (Lifetime Value)

Let’s get one thing straight — not all customers are equal. If you’re only tracking first-purchase revenue, you’re missing the bigger picture of how much a customer is truly worth over time. Some customers buy once and disappear, while others come back again and again, spending 10x more than their initial purchase.

This is why LTV (Customer Lifetime Value) matters more than short-term revenue. It tells you exactly how much a customer is worth over their entire relationship with your business — allowing you to scale profitably and outbid competitors who are stuck thinking short-term.

What Is LTV?

LTV (Customer Lifetime Value) is a critical metric that shows the total revenue a customer generates for your business over time. While many businesses obsess over first-purchase ROI, smart businesses focus on LTV because it lets them spend more on customer acquisition, dominate their industry, and crush competitors who don’t understand the long game.

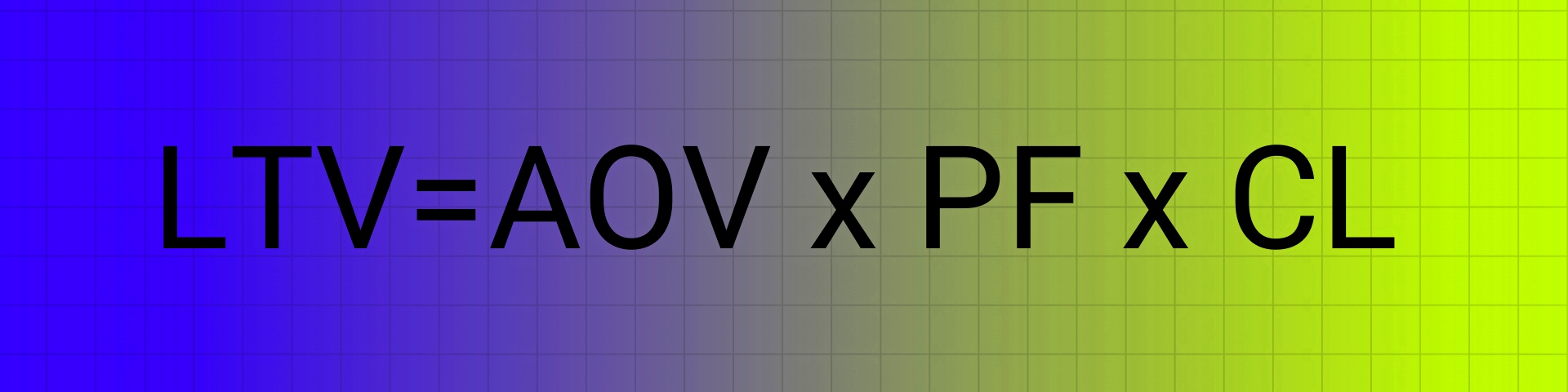

The Formula for LTV

LTV Formula Explanation:

- Average Order Value (AOV) → The average amount a customer spends per purchase. Calculated as Total Revenue ÷ Total Orders.

- Purchase Frequency (PF) → The average number of purchases a customer makes in a given period. Calculated as Total Orders ÷ Total Customers.

- Customer Lifespan (CL) → The average number of years a customer continues buying from your business. Calculated as 1 ÷ Churn Rate.

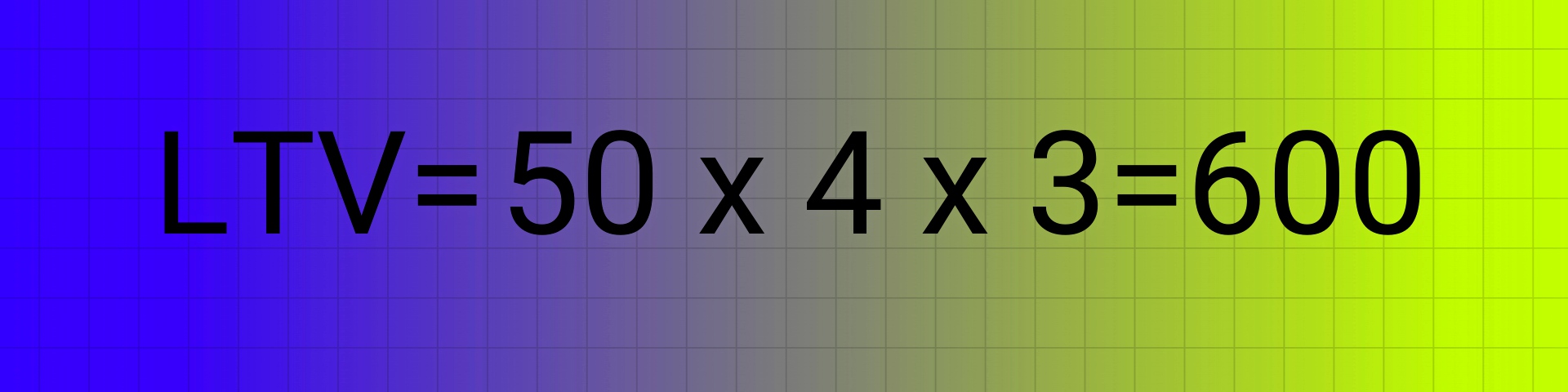

Example Calculation

- Your average customer spends $50 per order.

- They buy from you 4 times per year.

- They remain a customer for 3 years.

Why LTV Matters?

Most businesses fail to factor in LTV when setting their marketing budget. They look at CAC (Customer Acquisition Cost) in isolation and panic when they don’t break even on the first sale. But here’s the hard truth — breaking even (or even losing money) on the first purchase is fine if your LTV is strong.

LTV helps you:

✅ Outspend competitors – If they’re only spending $30 to acquire a $50 customer, but you know your LTV is $600, you can afford to spend much more to acquire customers.

✅ Make smarter pricing & upsell decisions – High-LTV customers are the real profit drivers, so optimize for them.

✅ Avoid shutting down profitable campaigns – Many businesses kill ads too soon because they don’t realize customers will keep buying later.

How to Improve LTV?

Tracking LTV isn’t just about looking at past data — it’s about actively increasing the value of every customer. Here’s how to measure and boost your LTV:

✅ Segment LTV by customer type: Not all customers are equal. Some buy frequently, others just once. Identify high-LTV customers and focus on acquiring more of them. Use GA4, Shopify, or CRM data to segment buyers by order history, AOV, and retention.

✅ Use cohort analysis to track long-term behavior: A customer’s first purchase doesn’t tell the whole story. Analyze how different customer segments behave over time. In GA4 → Explore → Cohort Analysis, track repeat purchase behavior over 30, 60, and 90 days.

✅ Measure repeat purchase rates: If customers aren’t returning, your retention strategy needs work. Use GA4 → Retention Reports to track how many customers return after their first order. If retention is low, focus on post-purchase engagement, loyalty programs, and reactivation campaigns.

How to Increase LTV:

🔥 Upsell & cross-sell effectively: The fastest way to increase LTV is to increase order value. Offer complementary products, bundles, or post-purchase upsells to maximize revenue per customer. Amazon-style recommendations (“Frequently bought together”) work well for eCommerce.

🔥 Improve customer retention strategies: Keeping a customer is 5-7x cheaper than acquiring a new one. Use personalized email campaigns, loyalty rewards, and exclusive content to keep them engaged. Retarget past buyers with tailored offers to boost repeat purchases.

🔥 Offer subscriptions or memberships: A one-time buyer can become a recurring revenue source. If your business model allows, create a subscription or VIP program with perks like discounts, early access, or free shipping to keep customers locked in long-term.

🚨 Common mistake: Many businesses think increasing traffic is the only way to grow revenue. In reality, increasing LTV is often easier, faster, and more profitable than acquiring new customers.

LTV vs. CAC (Customer Acquisition Cost): The Ratio That Determines If You Scale or Die

One of the most important financial ratios in marketing is LTV:CAC—it tells you whether your business is built for long-term profitability or heading toward disaster.

LTV:CAC Ratio = Customer Lifetime Value ÷ Customer Acquisition Cost

What Your LTV:CAC Ratio Means:

🔥 LTV:CAC = 1:1 → You’re breaking even, but growth will be difficult.

🔥 LTV:CAC = 3:1 → Ideal ratio — you’re making 3x what you spend to acquire a customer.

🔥 LTV:CAC = 5:1 or higher → You have room to scale aggressively.

🚨 Common mistake: If your LTV:CAC ratio is too low, you’re burning money acquiring customers who aren’t worth enough. Fix this before scaling.

Final Thoughts: If You’re Not Tracking LTV, You’re Making Short-Sighted Decisions

Every successful business focuses on long-term profitability, not just quick wins. LTV is the ultimate metric that separates businesses that thrive from those that constantly struggle.

If you’re not tracking and optimizing LTV, you’re stuck in a cycle of spending money on acquisition without maximizing revenue from existing customers.

V. Conversion Rate

Conversion rate is the single most important metric that determines whether your marketing efforts are profitable or just burning cash. You can have the best ads, highest traffic, and biggest social media following, but if visitors don’t convert, none of it matters.

A small improvement in conversion rate can dramatically increase revenue without increasing ad spend. That’s why optimizing conversions isn’t just an option — it’s a business necessity.

What Is Conversion Rate?

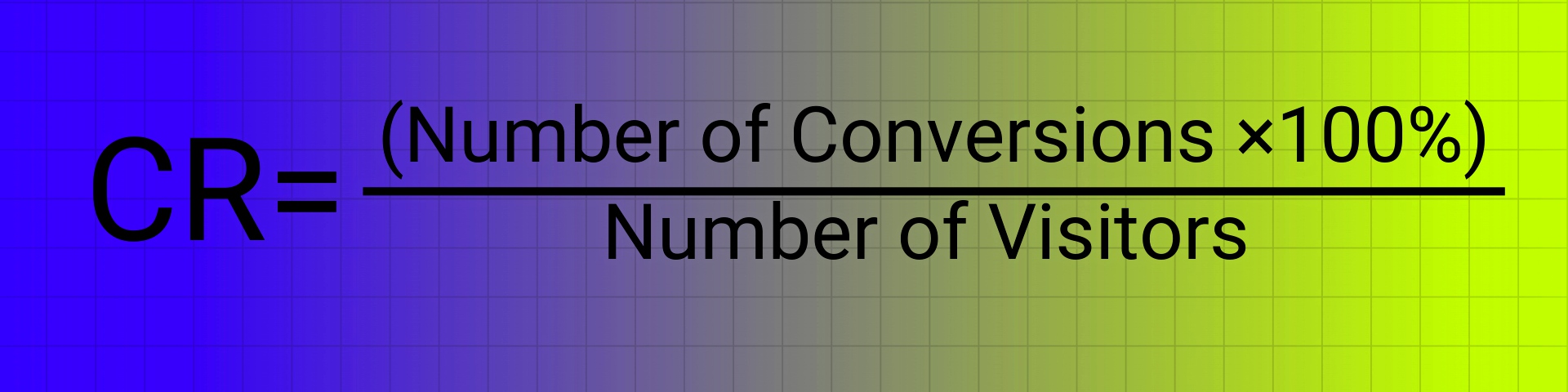

Conversion rate is the percentage of visitors who take a desired action on your website or marketing funnel. The action depends on your goal — purchases, signups, demo requests, or lead form submissions.

Formula:

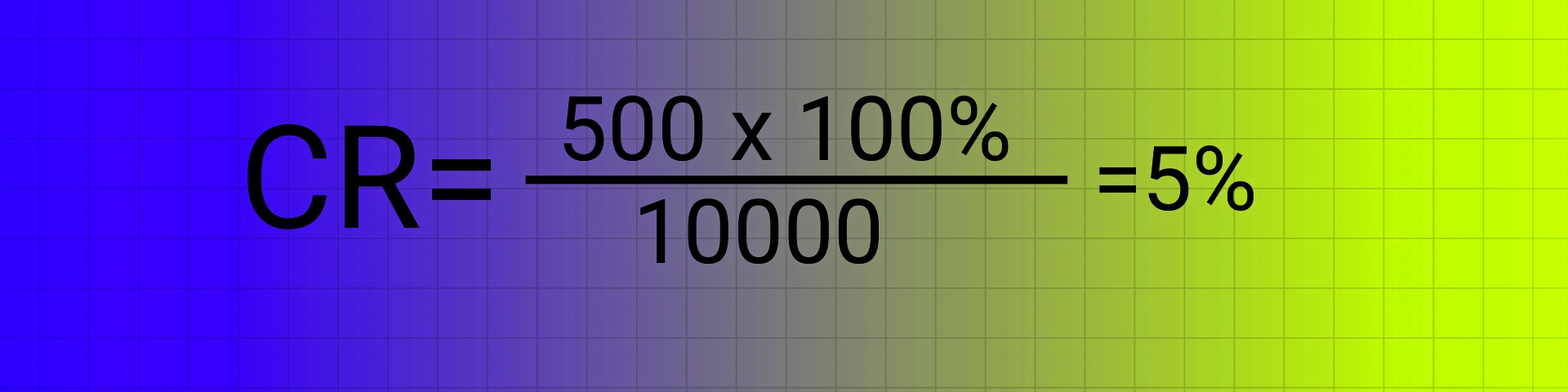

Example:

- If 10,000 people visit your website and 500 make a purchase, your conversion rate is:

That means 5% of visitors actually turn into paying customers, while 95% leave without buying.

Why Conversion Rate Matters?

Improving conversion rate means getting more sales from the same traffic—which makes your entire marketing strategy more profitable.

✅ Lower CAC (Customer Acquisition Cost) – If your conversion rate increases, your cost per acquisition drops since more visitors turn into customers without extra ad spend.

✅ Higher ROI on Marketing Spend – Every marketing dollar goes further when more of your visitors convert.

✅ Better Customer Experience = More Revenue – Optimizing conversion rate forces you to improve UX, trust signals, and overall website experience—leading to higher customer satisfaction and repeat purchases.

🚨 Common mistake: Many businesses focus on increasing traffic without optimizing conversions. If your conversion rate is bad, more traffic only means more wasted money.

What’s a Good Conversion Rate?

Average conversion rates vary by industry, traffic source, and audience intent. However, here’s a rough benchmark:

- eCommerce → 1.5% – 3%

- Lead Generation (B2B) → 3% – 8%

- Landing Pages for Ads → 10%+ (if well-optimized)

📌 Important: Instead of comparing to industry benchmarks, focus on improving your own conversion rate over time.

How to Improve Conversion Rate (Without Guesswork)

Optimizing conversion rate isn’t about random tweaks—it’s about testing, analyzing, and making data-driven decisions. Here’s what actually moves the needle:

✅ Fix slow load times: A 1-second delay in page load time can drop conversions by 7%. Use Google PageSpeed Insights to improve site speed.

✅ Simplify checkout process: The fewer steps in your checkout, the higher the conversion rate. Remove unnecessary form fields and allow guest checkout to reduce drop-offs.

✅ Improve mobile experience: Over 60% of online traffic is mobile. Ensure your website is fully responsive, with thumb-friendly navigation and easy-to-tap buttons.

✅ Use strong call-to-action (CTA): Vague CTAs like “Learn More” don’t work. Be direct: “Get Your Free Trial”, “Claim Your Discount”, or “Buy Now & Save 20%”.

✅ Leverage social proof: Trust signals like customer reviews, testimonials, and real-time purchase popups boost credibility and increase conversions.

✅ Run A/B tests: Test headlines, CTA colors, images, and copy to see what resonates with your audience. Tools like Google Optimize or VWO help run experiments.

✅ Use exit-intent popups: Capture abandoning visitors with last-minute discounts, lead magnets, or reminders before they leave.

🚨 Common mistake: Many businesses make big website changes without testing. Always A/B test before rolling out major updates to avoid lowering conversions accidentally.

Final Thought: Conversion Rate Optimization Is a Profit Multiplier

If you’re spending money on marketing but ignoring conversion rate, you’re leaving revenue on the table. A higher conversion rate means:

🔥 More sales without increasing ad spend

🔥 Lower customer acquisition costs (CAC)

🔥 Higher ROI across all marketing channels

Instead of chasing more traffic, make sure the traffic you already have is converting efficiently. 🚀

VI. CTR, Churn Rate & Retention Rate

While ROI, CAC, LTV, and Conversion Rate take center stage in marketing discussions, there are three other essential but often underestimated metrics that influence long-term profitability: Click-Through Rate (CTR), Churn Rate, and Retention Rate. These metrics don’t necessarily require their own massive breakdown, but ignoring them is a big mistake — they directly affect your acquisition costs, customer lifetime value, and revenue stability.

📌 CTR (Click-Through Rate): If No One Clicks, Nothing Else Matters

CTR measures how effective your ads, emails, or search listings are at capturing attention. A low CTR means people aren’t engaging with your content, making everything else—conversions, revenue, LTV—irrelevant. If customers aren’t clicking, they’re not buying.

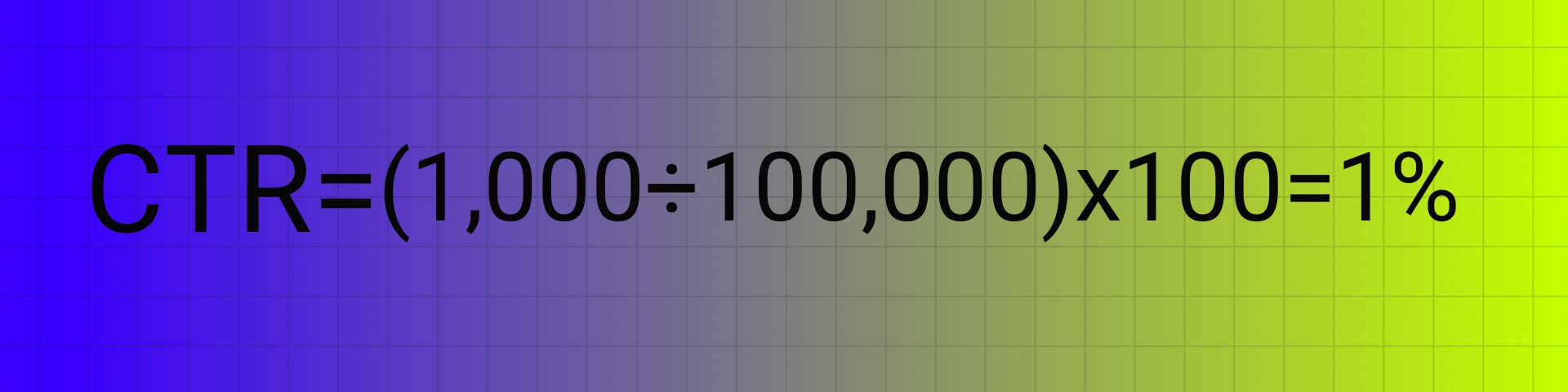

Formula:

Example:

- If your ad gets 100,000 impressions but only 1,000 clicks, your CTR is:

A good CTR depends on the platform, but generally:

- Google Search Ads: 3-5%+

- Facebook & Instagram Ads: 0.9-1.5%+

- Email Campaigns: 2-5%+

Why CTR Matters:

⚠️ A high CTR = lower customer acquisition costs (CAC). If more people engage with your ads, you’ll spend less per click and per acquisition.

⚠️ Direct impact on ad performance. A strong CTR signals to platforms (Google, Facebook, TikTok) that your ad is relevant, lowering CPC and improving rankings.

⚠️ Prevents wasted ad spend. If people aren’t clicking, your message is weak or your targeting is off.

How to Improve CTR:

✅ Write stronger, action-driven headlines: Test urgency, curiosity, and direct benefits (e.g., “Struggling with Low Sales? Fix It in 7 Days”).

✅ Use compelling visuals & contrasting colors: Eye-catching designs increase engagement. A/B test creatives.

✅ Refine audience targeting: If CTR is low, your ad is reaching the wrong people. Use lookalike audiences, interest-based targeting, and exclusions to filter out irrelevant users.

✅ A/B test CTA buttons & ad copy: Small tweaks in wording, colors, and placement can double or triple CTR.

🚨 Common mistake: Many businesses obsess over CTR without looking at post-click performance. A high CTR means nothing if those clicks don’t convert into customers.

📌 Churn Rate: Why Customers Keep Leaving?

Churn rate tells you how many customers stop doing business with you over a given period. If you’re bringing in new customers but losing old ones just as fast, you’re stuck in a never-ending cycle of high acquisition costs with no real profit growth.

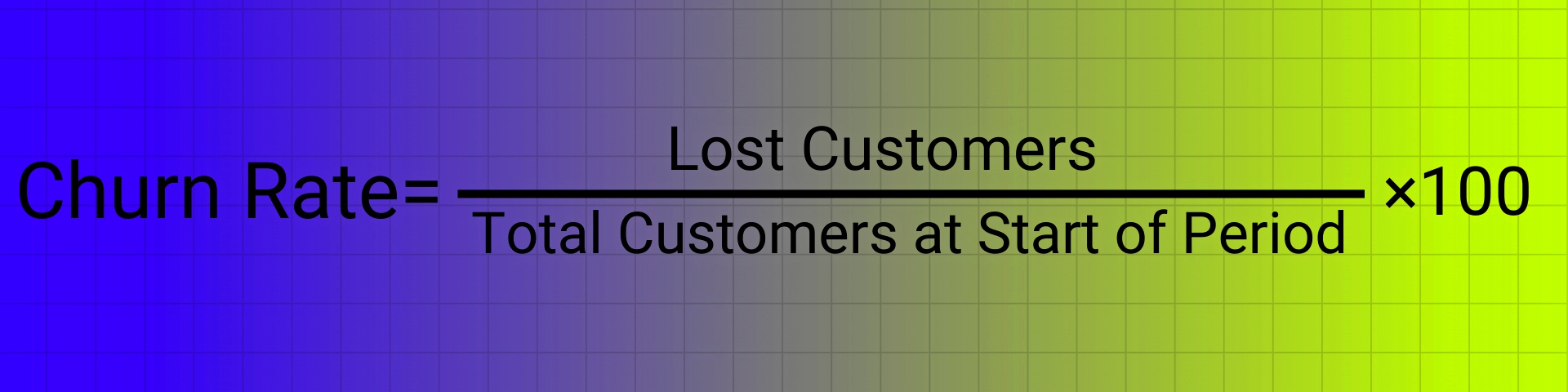

Formula:

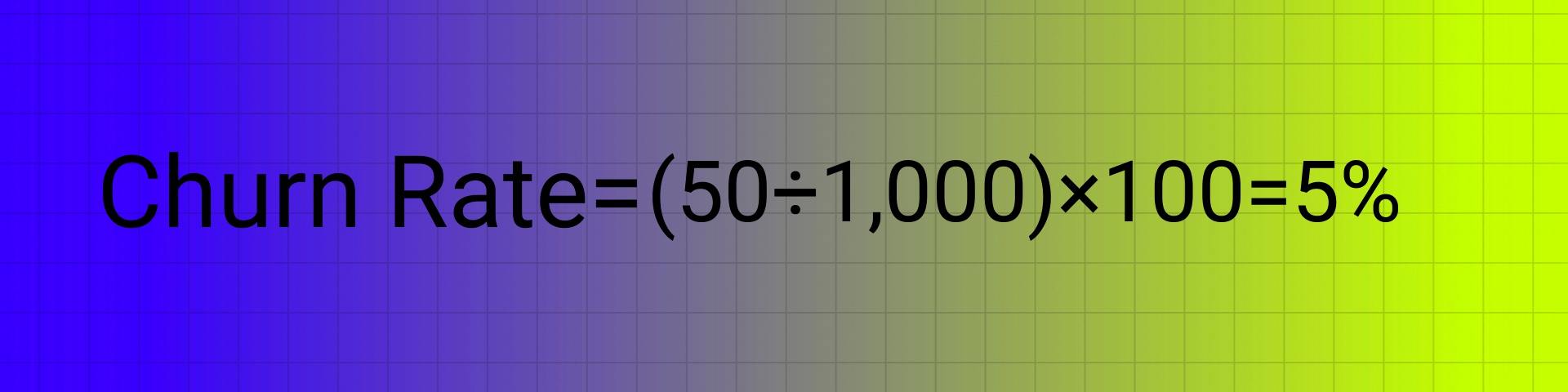

Example:

- You started the month with 1,000 customers, but 50 canceled or stopped buying.

What’s a Good Churn Rate?

Churn rates vary across industries, but here are rough benchmarks:

- Subscription-based businesses (SaaS, memberships) → 3% – 8% per month

- eCommerce (repeat purchases) → 20% – 40% annually

- Mobile apps → 20% – 70% in the first 30 days

- B2B Services → 5% – 15% annually

Why Churn Rate Matters:

⚠️ Direct impact on LTV. If customers leave quickly, their lifetime value (LTV) drops, making CAC less sustainable.

⚠️ Fixing churn increases profitability. Lower churn means customers stay longer, leading to higher revenue per customer

⚠️ Retention is cheaper than acquisition. Acquiring a new customer is 5-7x more expensive than retaining an existing one.

How to Reduce Churn:

✅ Improve customer experience — bad UX, slow support, or broken processes drive people away.

✅ Engage customers post-purchase — follow up with emails, tutorials, and loyalty incentives.

✅ Identify at-risk customers early — track inactivity and re-engage before they leave.

✅ Fix pricing issues — if customers see more value elsewhere, they’ll switch.

📌 Retention Rate: The Key to Scaling Without Burning Cash

Retention rate is the opposite of churn—it shows how many customers stick with you over time. High retention means higher LTV, lower CAC, and more profit without constantly spending on new customers.

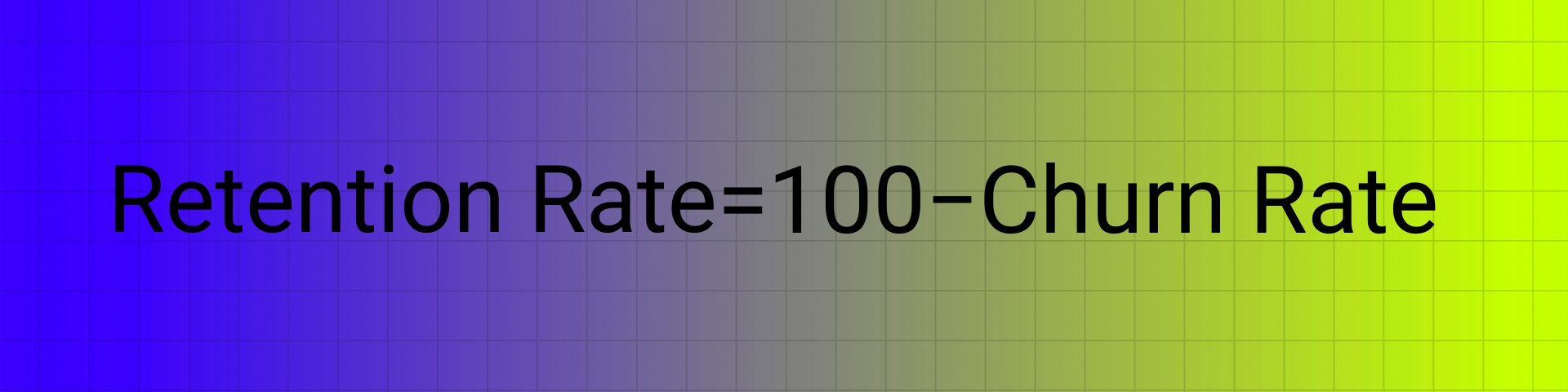

Formula:

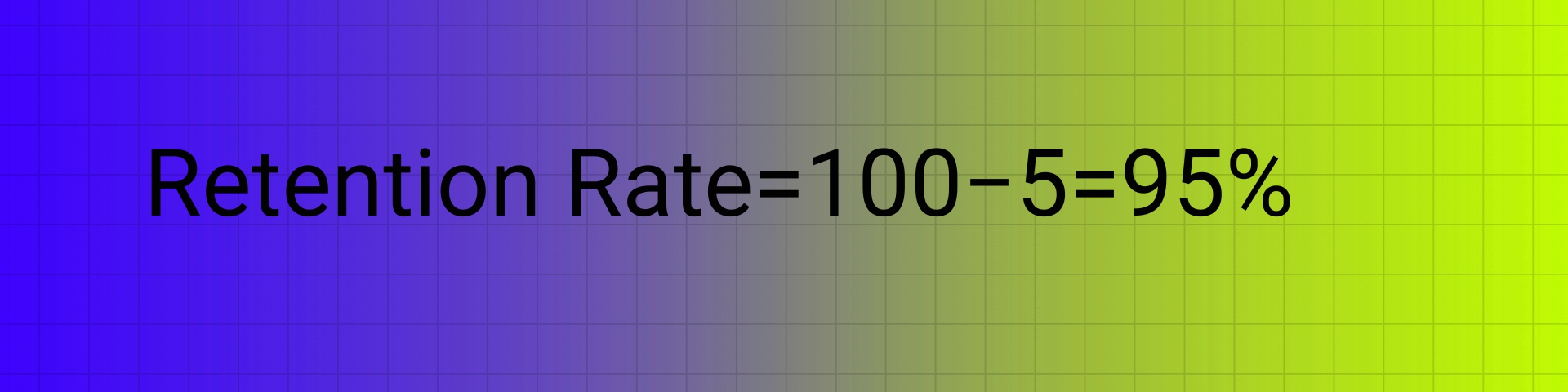

If your churn rate is 5%, then your retention rate is:

What’s a Good Retention Rate?

Retention rates differ based on business type and industry, but higher is always better:

- Subscription-based businesses (SaaS, memberships, apps) → 75% – 90% annually

- eCommerce (repeat customers) → 20% – 40% retention per year

- B2B Services (client retention) → 85%+ annually

How to Improve Retention:

✅ Personalization matters — customers are more likely to stay if you make offers tailored to them.

✅ Loyalty programs work — reward repeat buyers with discounts, perks, and exclusive access.

✅ Keep customers engaged — send product updates, valuable content, and special offers to keep them connected.

✅ Focus on customer support — fast, helpful service increases retention more than any discount ever will.

🚨 Common mistake: Many businesses treat retention as an afterthought, assuming customers will stay without effort. In reality, retention should be a core strategy, not just a lucky side effect.

Small Fixes in These Metrics = Massive Gains

CTR, Churn Rate, and Retention Rate may not be as hyped as ROI or CAC, but they serve as critical leverage points that determine whether your business is growing sustainably or slowly bleeding money.

✅ Higher CTR = Lower Acquisition Costs → When your ads, emails, and organic search results get more clicks for the same impressions, your cost per acquisition drops without increasing ad spend. This means your marketing budget stretches further, and you can outcompete businesses that rely on brute-force ad spending.

✅ Lower Churn Rate = More Long-Term Revenue → If fewer customers leave, you maximize the revenue potential of every acquired customer, which directly improves LTV. This allows you to spend more on acquisition profitably, knowing that customers will stick around and pay off over time.

✅ Higher Retention Rate = Less Reliance on Constant New Customer Acquisition → Instead of always fighting for new traffic and fresh leads, a high retention rate builds a compounding revenue stream. The longer a customer stays, the more repeat purchases they make, the more referrals they generate, and the stronger your profit margins become.

How Small Changes in These Metrics Create Massive Impact

Even a tiny improvement in any of these three areas can create exponential growth over time.

- Boosting CTR by just 0.5% can lead to lower CPC, higher engagement, and 15-30% more conversions without increasing ad spend.

- Reducing churn by 5% can increase profits by 25-95%, since repeat customers are more valuable than new ones.

- Increasing retention by 5-10% can double your customer lifetime value (LTV), allowing you to spend more to acquire high-value customers without fear of losing them.

Final Reality Check: Small Fixes, Big Results

Most businesses focus on spending more to grow, but fixing leaks in your funnel is often the fastest way to scale profitably.

- If CTR increases, you get more traffic for the same ad spend.

- If churn drops, you make more money from every customer without spending more.

- If retention increases, you scale without constantly chasing new buyers.

💡 The key takeaway? Before increasing ad spend or expanding traffic sources, optimize what’s already working. The most profitable businesses aren’t the ones that get the most new customers—they’re the ones that keep them the longest.

VII. The Only Metric That Really Matters… But Which One?

By now, you’ve seen how ROI, CAC, LTV, Conversion Rate, Retention, and other key metrics impact your business. But if you had to focus on just one metric, which would it be?

The truth is, there isn’t a single “magic number” that determines success—it all depends on your business model, growth stage, and goals.

↘️ If You’re Just Starting Out → Focus on CAC

When you’re launching a business or scaling a new product, customer acquisition cost (CAC) is the most critical number. If it costs too much to acquire customers, your business won’t survive long enough to improve other metrics. Your goal should be to lower CAC while maintaining profitability.

How to fix it?

✅ Improve targeting to attract high-intent customers

✅ Optimize conversion rates to get more sales from the same traffic

✅ Leverage organic & referral channels to reduce reliance on paid ads

↘️ If You’re in Growth Mode → Focus on LTV vs. CAC Ratio

Once you’re acquiring customers consistently, your biggest risk isn’t getting new customers—it’s making sure they’re profitable. This is where LTV (Lifetime Value) comes in. If you’re acquiring customers but not retaining them, you’re stuck in an expensive loop of constantly chasing new buyers.

Your goal at this stage? Maximize LTV while keeping CAC under control.

How to fix it?

✅ Improve retention with loyalty programs and personalized email marketing

✅ Upsell & cross-sell to increase average order value (AOV)

✅ Offer subscriptions or memberships for recurring revenue

↘️ If You Want to Scale Profitably → Focus on Retention Rate

Acquiring customers is expensive. Keeping them is where real profit happens. If you want sustainable, scalable growth, you need to stop focusing only on new customers and start maximizing the value of existing ones.

Retention is the difference between a business that burns through ad budgets and one that scales effortlessly through repeat sales and referrals.

How to fix it?

✅ Engage customers post-purchase with retargeting and email sequences

✅ Improve customer experience—fast support, seamless checkout, easy refunds

✅ Track churn & retention closely—identify why customers leave and fix it

Final Answer: It’s Not One Metric — It’s the Relationship Between Them

There’s no single metric that guarantees success. The real answer lies in balancing CAC, LTV, and Retention to create a sustainable, profitable business. The ultimate metric isn’t a single number — it’s the relationship between them.

✅ LTV:CAC Ratio → Determines if your business can scale.

✅ ROI → Ensures you’re making money, not just spending it.

✅ Conversion Rate → Maximizes revenue from existing traffic.

✅ Retention & Churn → Prevents constant customer loss.

If you get this right, your business scales effortlessly. Get it wrong, and you’ll always be chasing short-term wins without long-term profitability.

Instead of obsessing over any single metric, treat them as pieces of a bigger puzzle. When you get the balance right — profitable acquisition, high retention, and a growing LTV — you don’t just make marketing work. You build a business that can scale forever.